What is a "Black Swan Event" and How the Next One Could Shake the Financial World (again)

The term "Black Swan event" denotes an unexpected financial crisis with profound consequences, merging extreme rarity with a significant impact on stock markets and risk management.

Originating from an ancient Latin expression, these events challenge conventional wisdom within financial markets, underscoring the unpredictability that defies even the most advanced technical analysis. This exploration into what is a black swan event sheds light on its fundamental characteristics—its unexpectedness, devastating impact, and the human penchant for rationalizing such events post-occurrence as if they were foreseen.

Understanding black swan events is pivotal for anyone involved in the financial world, from traders to risk management professionals, as these events can lead to a market crash, reminiscent of the dotcom bubble or more extensive financial crises.

This article aims to delve into the anatomy of black swan events, offering insights into their historical precedents, implications for financial markets, and strategies to mitigate risks associated with such extreme occurrences. In doing so, it seeks to equip investors and traders with the knowledge to navigate the complexities of the financial landscape effectively.

FAQs

What Is a Black Swan Event in Finance?

A black swan event in finance refers to a highly negative and unpredictable occurrence. These events are so rare and unforeseen that they are considered impossible to anticipate, embodying unexpectedness and the unknown in financial contexts.

Can You Give Examples of Black Swan Events in History?

Notable instances of black swan events include the rise of the internet and the onset of the digital age, including the adoption of personal computing and mobile phones; the terrorist attacks on September 11, 2001; and the 2008 Global Financial Crisis, often referred to as the “Great Recession.”

How Do Black Swan Events Affect the Banking Sector?

In banking and investing, a black swan event signifies an extremely negative and unforeseeable event that has a profoundly adverse effect on the markets. These events are characterized by their unexpected nature and the difficulty in grasping their full scope and potential impact.

What Are the Three Main Characteristics of Black Swan Events According to The Black Swan Theory?

The Black Swan Theory highlights three critical attributes of black swan events: their rarity, their extreme impact, and the fact that they can only be predicted in hindsight, not in advance. These features underline the challenges in foreseeing and mitigating such events.

Understanding Black Swan Events in the Financial Market

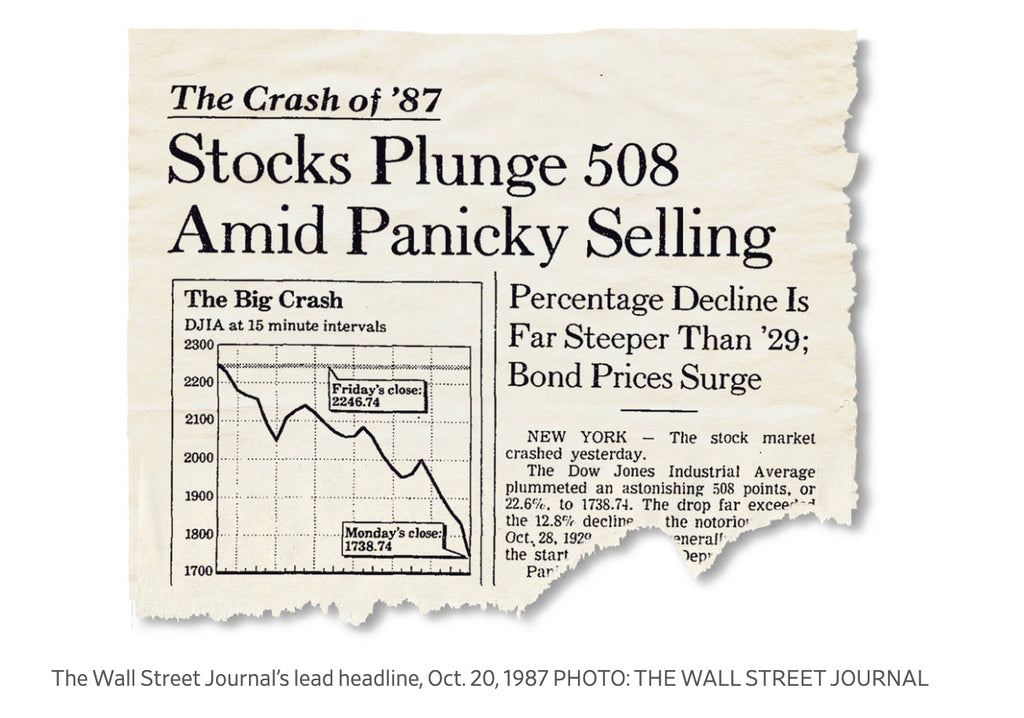

Understanding the intricacies of Black Swan events in financial markets is crucial for anyone looking to safeguard their investments against unforeseen catastrophes. These events, characterized by their extreme rarity and profound impact, have historically led to significant market upheavals, such as the 1987 stock market crash and the 2008 financial crisis.

Unlike market corrections, which are somewhat predictable and short-lived, Black Swan events are notoriously unpredictable and can have long-lasting consequences on the global economy.

- Rarity and Impact: Black Swan events are exceptionally rare but carry significant repercussions when they do occur. Historical instances like the 2020 global pandemic, the 2008 financial crisis, or the 1987 and 1929 stock market crashes highlight their potential to fundamentally alter financial landscapes.

- Unpredictability and Management: The inherent unpredictability of these events makes them challenging to forecast using standard risk management and technical analysis tools. This unpredictability necessitates a diversified approach to investment and risk management, blending traditional models with intuition and flexible strategies to mitigate potential impacts.

- Positive and Negative Outcomes: While the term 'Black Swan' often infers negative connotations, it's important to recognize that not all unforeseen events have detrimental effects. Some can lead to positive developments, influencing humanity and world history in beneficial ways. However, the primary focus within financial markets remains on mitigating the negative impacts through proactive risk management and strategic planning.

By understanding these key aspects, investors, traders, and financial professionals can better prepare for the unpredictability of Black Swan events, employing a mix of modeling, intuition, and simple investment strategies to create a more resilient investment portfolio.

Historical Examples of Black Swan Events

Diving into the annals of history, we encounter several instances that perfectly illustrate what is a black swan event, reshaping financial markets and challenging the robustness of risk management strategies. These events, marked by their extreme rarity and profound impact, have left indelible marks on the global economy:

The 2008 Financial Crisis: Triggered by the collapse of the U.S. housing market, this crisis spiraled into a global banking disaster, leading to a severe economic downturn. Its unforeseen nature and extensive impact make it a textbook example of a black swan event in the financial world. The crisis underscored the vulnerability of financial markets to intricate interconnections within the global economy, prompting a reevaluation of risk management practices.

The Dotcom Bubble Burst (2000): Characterized by the meteoric rise and subsequent fall of internet companies, this event resulted in a severe market correction. It highlighted the dangers of speculative bubbles in tech investments and the necessity for more grounded valuation methods in the stock market.

The COVID-19 Pandemic (2020): As an unprecedented global health crisis, COVID-19 had significant repercussions on economies and markets worldwide. The

pandemic's rapid spread and the drastic measures taken to contain it led to widespread economic disruptions, illustrating the unpredictable nature of bl

ack swan events and their capacity to trigger a market crash.

9/11 Terrorists Attack (2001): The first week of trading after the attacks saw the S&P 500 fall more than 14%, while gold and oil rallied. The industries most directly impacted were airlines, whose flights were subsequently grounded, and insurers, who paid out billions of dollars in claims, including to victims and property owners.

The Oil Embargo (1973–1974): The 1973 Oil Embargo acutely strained a U.S. economy that had grown increasingly dependent on foreign oil. The onset of the embargo contributed to an upward spiral in oil prices with global implications. The price of oil per barrel first doubled, then quadrupled, imposing skyrocketing costs on consumers and structural challenges to the stability of whole national economies.

Stock Market Crash (1929): The pivotal role of the 1920s' high-flying bull market and the subsequent catastrophic collapse of the NYSE in late 1929 is often highlighted in explanations of the causes of the worldwide Great Depression. It was the most devastating stock market crash in the history of the United States when taking into consideration the full extent and duration of its aftereffects. It was the beginning of the 1930’s Great Depression.

These historical examples serve as stark reminders of the unpredictability inherent in financial markets and the importance of preparing for the unforeseeable, emphasizing the critical role of effective risk management and technical analysis in navigating the tumultuous waters of the financial world.

Strategies for Identifying and Mitigating Black Swan Risks

In the unpredictable landscape of financial markets, understanding and preparing for black swan events is crucial. Here are key strategies for identifying and mitigating black swan risks:

- Diversification and Emergency Funds:

- Maintain a diversified portfolio across various asset classes and sectors.

- Build a substantial emergency fund to weather unforeseen financial storms.

- Consider mixed funds to balance financial complexity with simplicity, avoiding portfolio concentration.

- Risk Management Techniques:

- Employ stop-loss orders and closely monitor portfolios during times of volatility.

- Hedge risks using options and derivatives to minimize losses.

- Stay informed about global events and foster a culture of risk awareness.

Looking Ahead

It’s often stated that “history repeats itself.” When considering current economic conditions one must contemplate the vast array of variables that could potentially lead to the next Black Swan event. Factors such as fast rising inflation and interest rates, overall student loan complexities, illegal immigration to the US, artificial intelligence growth (AI), and bull markets rising exponentially to all time highs all have the possibility to contribute to future economic downturns and hardships.

Through the exploration of black swan events and their monumental impacts on the financial world, this article has illuminated the inherent unpredictability and potential devastation these rare occurrences can bring to global markets. By underscoring examples such as the 2008 financial crisis, the dotcom bubble burst, and the COVID-19 pandemic, we've seen firsthand the critical importance of resilience and strategic risk management within the financial sector. These instances not only serve as a reminder of the unpredictable nature of the financial landscape but also highlight the necessity for individuals and institutions alike to adopt a proactive stance in preparing for unforeseeable events.

In navigating these tumultuous waters, embracing strategies that include diversification, emergency fund creation, and the incorporation of advanced risk management techniques stand out as indispensable tools. For those looking to delve deeper into effective strategies for managing the unexpected, insightful resources on risk management offer valuable guidance.

As we move forward, the lessons garnered from past black swan events must guide our preparations, ensuring that both individuals and markets are better equipped to handle the unpredictable with grace and resilience.

* * * * * * * * * * * * * * * * * * * * *

Anyone 55 or older (like me) may remember waiting in very long gas lines as a kid in the mid 1970s during the Oil Crisis. I didn't realize what really was going on but I remember it vividly.

I was in MBA school when the stock market crashed nearly 25% in 1987. I wasn't trading or investing then but thought I sure wish I had $500 to put into the markets the next day but sadly I didn't...

At that time my career goals were to go work on Wall Street but tens of thousands of people lost their jobs and I went in a different direction. Now I feel like I get to work virtually on Wall Street as a trader (pretty cool if you ask me.)

During the 1990s dot com bubble it was truly euphoric (feels a lot like AI and Bitcoin now). The only strategy that you needed to know back then was to buy low and sell high. That worked until the bubble burst... (remember "irrational exuberance statement by then Fed Chair Greenspan?)

9/11/2001 and what happened afterwards seemed totally surreal. I likened that to my grandparents version of Pearl Harbor but somehow this seemed worse. I'll never forget where I was when I heard what happened that morning. During the late 1980s my then girlfriend now wife of 33+ years were able to go to the top of the observational deck of the World Trade Center, to this day I remember seeing airline jets making their way to nearby airports.

Then in 2008-2010 time frame during the housing crisis that tanked the financial markets things seemed unprecedented (at least in our life time). Zero percent interest rates for a decade seemed to solve that but now we're seemingly dealing with the repercussions of that. (I remember CD interest rates were 18%-20% during the late 1970s early 1980s time frame so when my wife and I bought our first house in 1990 we thought 7.75% interest was really really low. It's all relative isn't it because most of you think interest rates are extremely high right now...

The global pandemic was another interesting and unprecedented time for essentially every living person of which many are still struggling to recover while others are flying high.

All this to say that for me it doesn't seem like a matter of "if" the next Black Swan event happens rather, it seems like just a matter of "when and what could it be."

I'd really like to hear your perspectives on these events and your personal experiences. Feel free to send me a message that will come directly to my Inbox at this link or leave a comment down below.

- Tom Winterstein

PS - Could you imagine the markets falling 22.6% in a single day now like they did in 1987? Well they can't because of regulations put in place after that but it could happen over several days / weeks.