February 21 Chart of the Day - Nvidia

Precision oriented price action technical analysis by far provides the best edges and most setups for traders across the markets so that's what we use for the basis of our reviews.

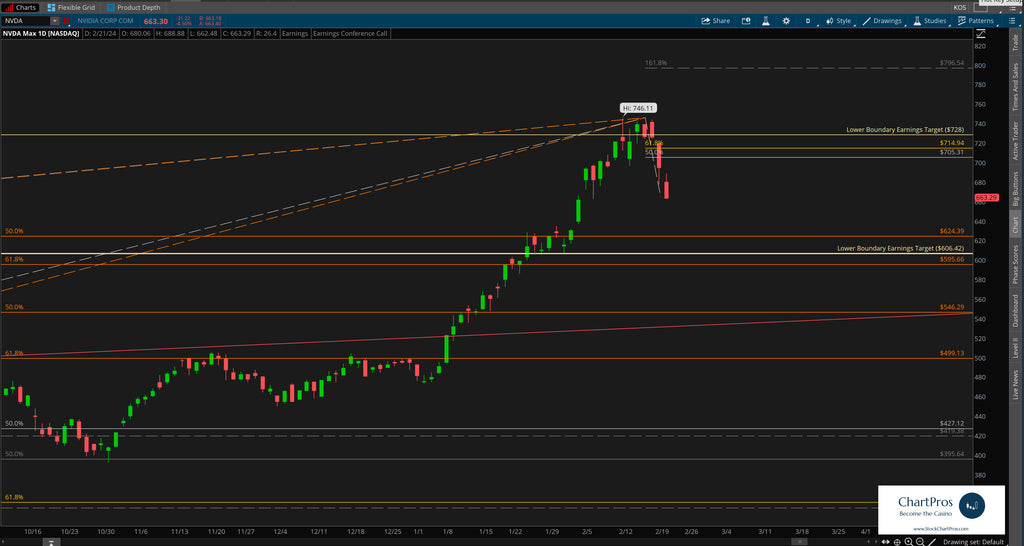

Nvidia (NVDA) by far has been the most requested chart in a very long time. Most likely because they report earnings after the closing bell today.

We intentionally waited until the last hour of the regular trading hours (RTH) so as to obtain the latest at the money straddle options cost to determine what move the market is anticipating in either direction by the end of this week.

Editors note: We do not currently have a position in NVDA nor are we planning to trade it before earnings.

So with that in mind we're going to just cut to the chase and provide you the weekly and daily charts with the levels of interest of where price could go based on price action technical analysis.

Weekly

So what's next?

We don't make predictions...

Nobody knows for sure but using these 5 price action tools traders and investors can develop levels of interest in both directions.

- Support/Resistance

- Trend

- Fibonacci

- Supply/Demand Zones,

- Change Control Zones

ChartPros provides the exact methodology in its price action technical analysis courses to create charts like this with the most precise and accurate levels from which investors and traders can formulate their respective trade plans.

Take a look at the charts and let us know what you think.

We'd like to hear from you in the comments sections.

Have a chart you'd like to see featured?

Send requests at https://stockchartpros.com/community/contact

Would you like charts like this delivered directly to you every day? ChartPros Trade Room is offering an OPEN HOUSE 7-day free trial at this link.

Experience a Week In the Life of a ChartPros Trade Room Member!